There are almost as many reasons to purchase

life insurance

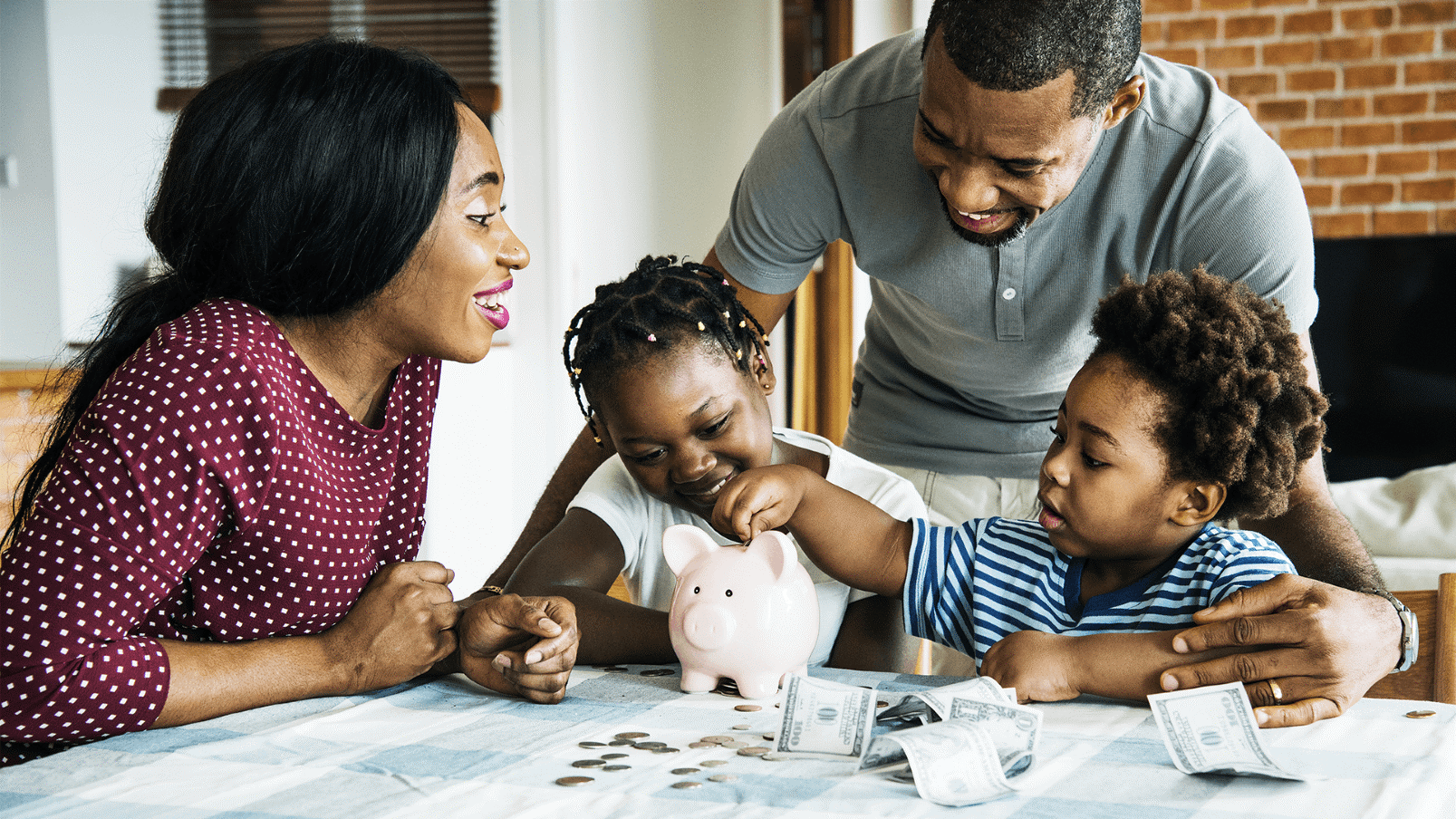

as there are types of policies. When you buy life insurance, you are buying peace of mind, knowing that if you die while the policy is in force, the insurance company will pay your named beneficiaries the policy proceeds. This can provide needed funds to allow your beneficiaries to continue their current standard of living, pay off debts, or help fund long-term goals, like paying for children's education or living comfortably during retirement.

There's another benefit that comes with life insurance proceeds: in most cases, policy benefits are income-tax free to recipients, meaning they will be able to receive the full benefit amount without carving out a percentage for Uncle Sam.

When Policy Proceeds May be Taxable

There are limited situations in which a portion of life insurance proceeds from permanent (whole life or universal life) policies may need to be reported for tax purposes.

First, if your beneficiaries elect to take their payment in periodic installments instead of as a lump-sum distribution after your death, they will likely earn interest on the undistributed portion while it sits with the insurance company. That interest will be taxable income to your beneficiaries (although the proceeds themselves are still not taxable).

Second, if your whole life or universal life insurance policy accumulated a significant amount of cash value and that cash value was greater than what you paid into the policy in premiums, a portion of the cash value paid out may be taxable income to the recipients.

A third scenario that can be taxable relates to unpaid policy loans. If you have a whole life or universal life insurance policy, one benefit is the ability to borrow against your cash value. However, if you surrender your life insurance policy or if the policy lapses while you still have one or more outstanding policy loans, and if the outstanding loan balance is greater than the amount you paid into your policy, you will have to report income and pay some taxes.

What About Estate Taxes?

Life insurance proceeds are considered part of your overall taxable estate when you die, for purposes of calculating estate taxes owed. However, most Americans are not subject to federal estate taxes. For

2018

, an individual can exclude $10 million (indexed for inflation) and a couple can exclude $20 million from federal estate taxes. Some states also have state estate taxes with different exemption amounts, so your estate may be subject to state, but not federal, taxation when you die.

If a portion of your estate is taxable, talk to your independent insurance agent about how using life insurance can help you create liquid assets that your loved ones can use to pay estate taxes. One strategy is to work with an attorney to create an irrevocable life insurance trust (ILIT) to keep the proceeds of your life insurance outside of your taxable estate. When the policy benefits are paid, they can be used to pay off any estate tax obligation.

Learn More About the Benefits of Life Insurance. Talk to Your Symmetry Financial Group Independent Insurance Agent.

The fact that life insurance proceeds are generally income-tax free to beneficiaries can be a significant benefit for them - and for you. You should always consult with a tax professional to discuss the specific tax implications for your own situation, but in most cases, life insurance will not create a taxable event.

Your

Symmetry Financial Group

Independent Insurance Agent can be a valuable resource as you explore ways to provide protection and asset liquidity for your loved ones. Rather than simply trying to sell you an insurance policy, your insurance agent will take the time to listen to what's most important to you, so they can create a strategy and plan that makes sense based on your goals and your budget.

To learn more and to request a quote,

contact us

, or call us at (877) 285-5402.