Obtaining life insurance is one of the best moves you can make towards protecting your loved ones. A dizzying array of insurance carriers and available policies can make it tough to know where to begin and how to choose the right plan. In this blog post, we'll present some tips, considerations, and other information designed to help you make better informed decisions.

Tips for choosing the right insurance policy

1.

Work with an independent Symmetry agent

. Trying to navigate the world of insurers, policy types, and available options by yourself can be an exercise in frustration. Making matters worse, you could end up with something other than the coverage you think you're buying. Choose an independent Symmetry insurance agent who has access to a variety of carriers and policies to ensure you end up with a personalized option.

2.

Know what kind of policy you're looking for

. If you start your search without a clear picture as to whether you're looking for term insurance or a more permanent solution, it will be tough to compare policies. Your Symmetry agent should help you narrow down what you're looking for by examining your goals and priorities, so he or she can help find a policy that best meets your needs.

3.

Get a variety of quotes

. Don't get just one quote for one type of policy from one insurance company. Ask your Symmetry agent to provide policy quotes with different options so you can truly compare what's available to you.

4.

Consider buying more than one policy

. If a needs analysis shows you need a certain amount of coverage but a review of policy quotes confirms that coverage level is beyond your budget, consider buying both permanent and term insurance to get to the right level. Your Symmetry agent can help you effectively evaluate different combinations of policies.

Things to consider when choosing an insurance policy

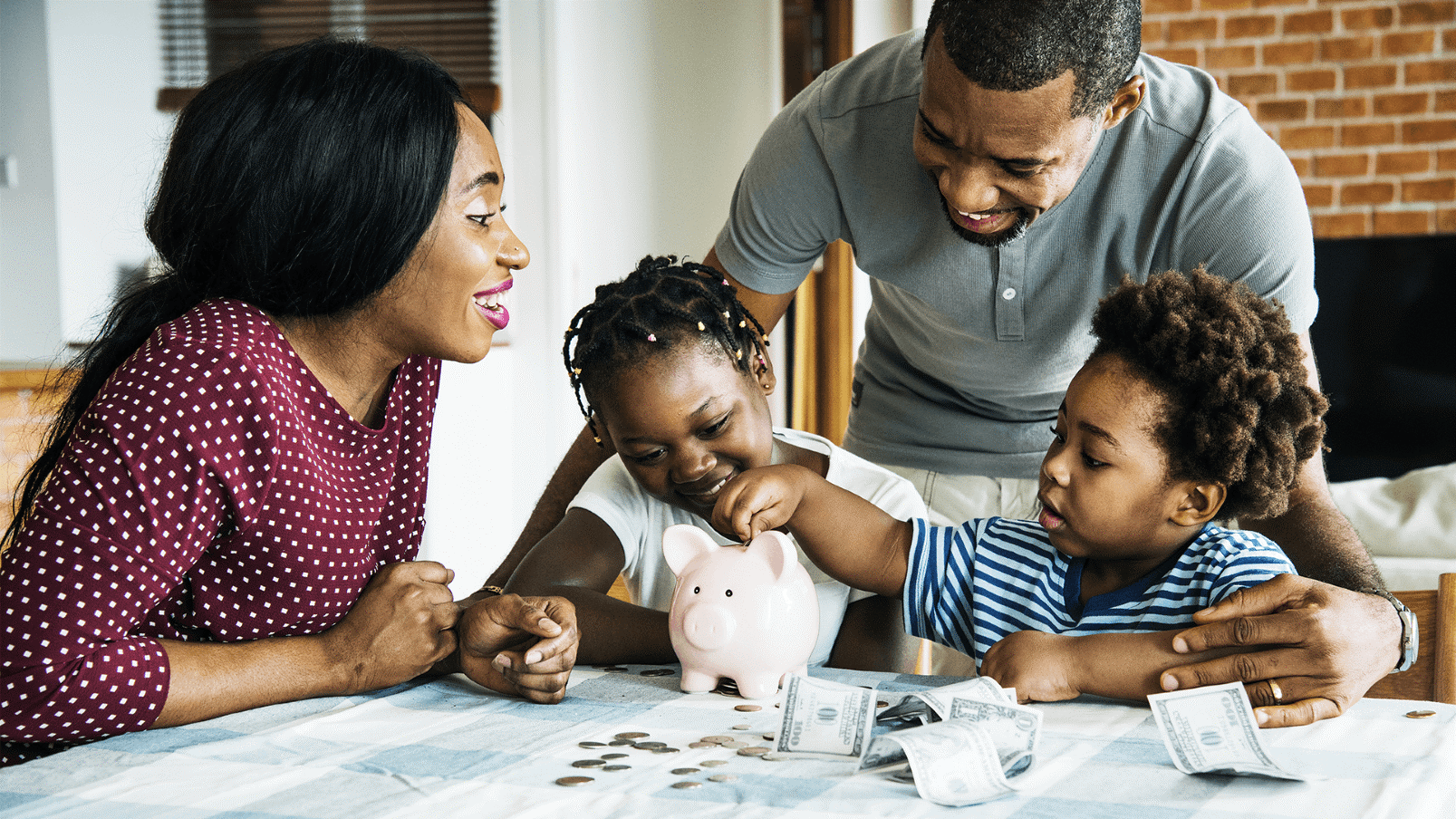

While you may have initially started your search for a personal insurance policy, consider expanding coverage to protect everyone in your family. Obtaining life insurance for minor children now can help defend their future insurability while also providing a source of funds that could be used to pay your final expenses in the event that the worst was to happen.

When you

purchase life insurance,

you make a commitment to pay enough premiums to the insurance company to keep the policy in force. Treat your life insurance premium like you would any other fixed expense; stay on top of payment due dates.

Finally, if you have existing life insurance coverage under an employer-sponsored plan, great! But, don't rely solely on that policy to meet your needs. If your employment ends, you probably will not be able to continue coverage under that plan. Even if your policy is "portable,"premiums may be too high for you to maintain, and in the meantime, your insurability may have changed for the worst. Use your employer-sponsored insurance options as a supplement to your private policies.

What you should know about choosing life insurance

Always remember that you are the customer. You should feel comfortable that any insurance policy you decide to purchase is the right move for you and your family. To that end, don't be afraid to ask questions and make sure you understand how the policy you are purchasing works. Understand the amount of policy premiums you will need to pay periodically to keep the policy in force.

Just as your own needs can change over time, policies can also evolve. When you receive notices from your insurance company about your policy, be sure to read them carefully. If you don't understand something, talk to your Symmetry agent. You should also plan on regular "checkups" with your agent to confirm your insurance policies continue meeting your needs.

Choose Symmetry Financial Group

When you are searching for an insurance agent to help you navigate the often confusing world of life insurance, look no further than

Symmetry Financial Group

. As an independent insurance agency, we have access to affordable, quality insurance policies from dozens of carriers. We work closely with our clients to understand their needs so we can propose solutions designed to fit those requirements - and our clients' budgets.

To get started protecting your family with life insurance,

contact us today online

or call us at (877) 285-5402.