If you are considering

buying life insurance

, you probably want to know what it is going to cost you every month or every year. Unfortunately, there is no simple answer or fixed dollar amount to quote you at without knowing more about your financial situation, life insurance needs, goals, and the type of coverage that best meets those needs and goals.

Factors that Influence the Cost of Life Insurance

Several factors go into life insurance pricing, including the following:

-

Type of Insurance Coverage

. First, the cost of life insurance is largely driven by the type of policy you are considering purchasing.

Term life insurance

, which provides coverage for a fixed number of years, is typically the least expensive type of coverage. However, it may not cover (or may not fully cover) your needs.

Universal life insurance

is designed to be “permanent” coverage, offering protection for your lifetime or until the policy’s maturity date (often age 100 or even higher). Since insurance companies are more likely to have to pay a claim on a permanent insurance policy, the cost of insurance is higher.

-

Amount of Insurance

. Next, the amount of life insurance protection you need will also impact the cost of the policy. All other things being equal, a $250,000 policy will cost more than a $100,000 policy.

-

Your Age at the Time of Application

. The amount you’ll pay for life insurance also depends on your age at the time you apply for coverage. Coverage generally costs less when you are younger; waiting to buy coverage could end up making your policy premiums higher simply because you will be older at that point.

-

Nicotine Use

. If you are a smoker or use smokeless tobacco products, you may pay more for life insurance than people who don’t use nicotine products.

-

Your Gender

. Statistically speaking, women live longer than men. Because of this, women generally pay lower life insurance premiums than men do.

-

Your Occupation and Hobbies

. Your lifestyle also influences the amount of your life insurance premiums. Office workers will generally pay lower premiums than construction workers. Your hobbies can impact your rates too; if you like to skydive, scuba dive or regularly engage in other activities that are potentially risky, you may be asked to pay more for coverage. Alternatively, your life insurance policy might simply exclude those activities from coverage.

-

Where You Live

. The part of the country you live in can also impact the cost of life insurance, although these price variations tend to be relatively small. If you live in a state or region that has higher rates of disease, crime, obesity or natural disasters, your cost of insurance may be higher than if you lived in a part of the country where the risk of those types of events is lower.

-

Your Health

. The cost for your life insurance policy will also depend on your overall health. When you apply for coverage, you will be asked a series of questions including your height and weight, whether you have been diagnosed with common or serious health conditions, whether you take any medications, etc. People who are generally healthy can expect to pay less for coverage than people with one or more physical or mental health conditions.

Don’t Underestimate the Cash Value of Universal Life Insurance

If you are comparing term insurance and universal life insurance policies on cost alone, you are comparing apples and oranges; the two types of policies are quite different.

While

Universal life insurance

policies are more expensive than term coverage, remember that they also come with a cash value component. When you buy term insurance, your entire premium payment goes to pay the cost of insurance coverage. You are protected throughout the entire term of the policy. However, if you outlive the policy term, you may need to start the process of buying insurance coverage again. Because you are older at that point, you will likely pay more for coverage – sometimes significantly more.

With universal life and other types of cash value insurance, a portion of your premium payment goes to fund the cash value account inside your policy. That cash value grows, tax-deferred, right inside the policy. What’s more, many insurance companies offer attractive, guaranteed interest rates for the cash value account. If you need to withdraw cash or take a policy loan at some point in the future, you can do so. Of course, draining the cash value account could be detrimental later in life as without it, you may not be able to afford to pay the rising cost of insurance.

Things You Can Do to Lower the Cost of Insurance

Obviously, you cannot change your age, and it is not practical to move to another part of the country simply to get lower rates on your life insurance. However, there are some things you can do that can lower the amount of life insurance coverage:

-

Stop Smoking

. If you’re a nicotine user, quitting can positively impact your rates on life insurance.

-

Manage Your Weight

. Similarly, achieving and maintaining a healthy weight for your age, height and gender can keep your costs down. That’s because being overweight has been linked to several serious, chronic health conditions.

-

Take Control of Your Health

. Visit the doctor for annual physicals, keep your blood pressure and blood sugar under control, exercise regularly and eat a balanced diet.

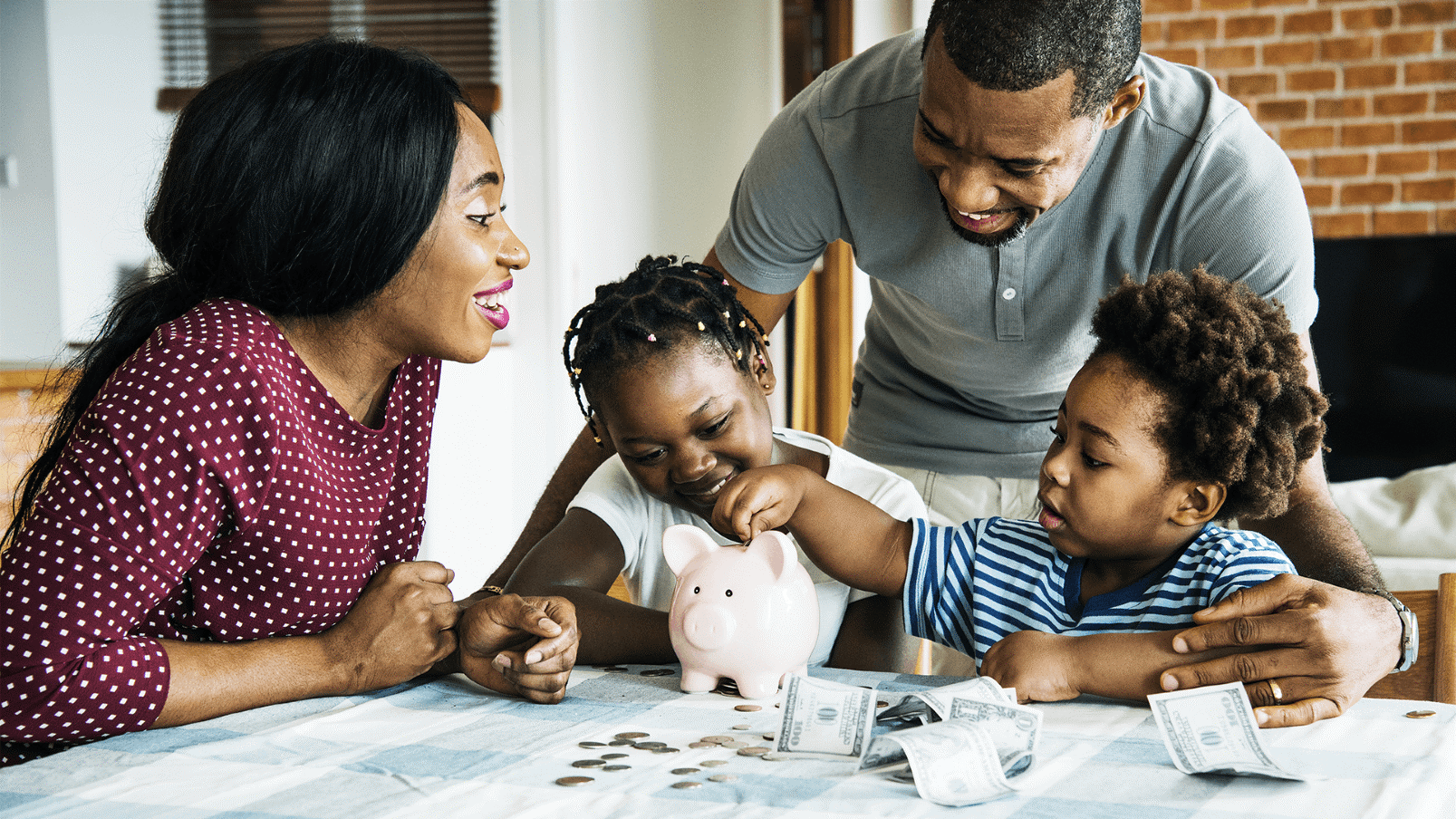

Ways to Fit Life Insurance into Your Budget

If the life insurance quote you receive is higher than what you think you can afford, don’t dismiss it out of hand. Think of the reasons you need life insurance in the first place, to protect and financially support your loved ones if you pass away.

Your insurance agent can help you customize coverage, tailoring the type of insurance and the amount of coverage to meet your needs. This may include a combination of term and permanent coverage, rather than simply relying on one or the other.

Strategies to find extra wiggle room in your budget may include cutting back on the number of nights you eat out each month. If you’re used to a $60 family dinner at your favorite restaurant every week, just cutting out one night a month and cooking at home could help pay for insurance coverage!

Making more cost-conscious purchases at the grocery store and on everyday purchases, brewing your own coffee rather than purchasing it at a coffee shop every day, and making modifications to entertainment expenses can all add up to savings too – savings you can apply toward life insurance protection.

Trust Symmetry Financial Group to Help You Find Affordable Protection

So, how much will your life insurance policy cost? As you can see, it is impossible to provide a quote without knowing more information about you. However, the Independent Insurance Agents at Symmetry Financial Group are committed to helping people protect their loved ones with life insurance that meets their needs and their budgets.

To get started and to request free life insurance quotes,

contact us

today.