Figuring out how much life insurance you need can sound like a daunting task. However, it can be as simple as asking yourself a few questions. In this article, we will look at the reasons why you would need to purchase life insurance in your 30’s and offer advice on how much life insurance you should consider purchasing.

Who should purchase life insurance?

If you own a business or have any business dealings on the side, life insurance is essential. Getting a life insurance policy in place when you are just starting out can help you confidently prepare for the unexpected. If you renovate houses or run an online business, what would happen if you unexpectedly passed away? Having life insurance ensures that your loved ones will have the funds necessary to take care of your business, stress-free.

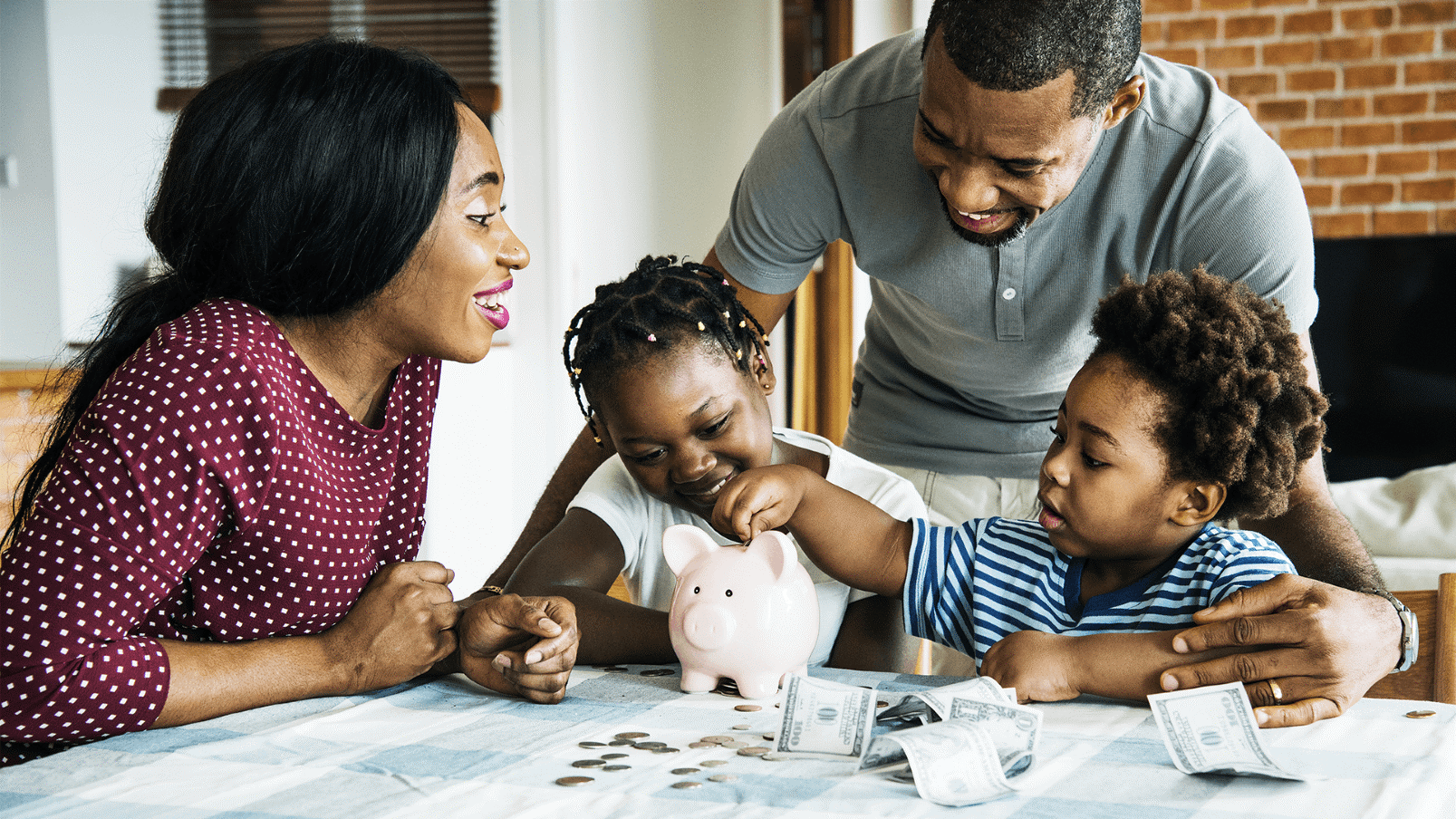

If you are married or single with children, life insurance can provide the financial support necessary to continue raising your children if you passed away. If you have dependents, but don’t have enough savings in place to support them financially in the event of your passing, then you should definitely consider purchasing life insurance.

Additionally, if you have accrued any debt, from college loans or elsewhere, a life insurance policy can be used to cover these expenses if you were to pass away before you finished paying off the debts. Doing so will prevent your family members from having to pay these costs during a time of grief.

How much insurance will you need?

To figure out how much life insurance you should purchase, consider your income, debts, mortgage payments, and estimated final expenses. You should also think about the future growth of your income and assets. Most advisors recommend purchasing a little more coverage than you initially project, just in case your expenses rise in the coming years.

The amount of insurance that you need will depend on your current financial situation and your plans. Look at how much you earn and how much income you want to provide your family in case you weren’t there to support them financially. Also, look at what expenses you’d like to cover for your family in the future: would you want to set aside funds for your child’s education?

Here are some things to consider when purchasing life insurance in your 30’s:

• Income projection over the span of your career

• Debts you may leave behind

• Burial costs, estate taxes, final expenses

• Medical debt or bills

• Future college expenses for your children

If you are married, you will also need to consider how much financial support your spouse will need in order to survive if you pass away. This will help you get an overall estimate for how much life insurance you’ll need. For a more detailed view, your insurance agent can help you find the right fit for your current budget and needs.

Considering cost

For people in their 30’s, it might be surprising to find out that now could be the best time to buy life insurance. The main benefit of purchasing life insurance when you’re in your 30’s is to lock in a low premium. It can be more affordable to get life insurance when you are young and healthy because insurers are more likely to cover people who present less “risks.” People who are young, healthy and non-smokers are generally offered a lower rate.

>>> Check out life insurance prices:

Request a Quote

now for rates

The great thing about purchasing a policy in your 20’s or 30’s is that you can lock in the lowest price and keep that rate for a long time. Many people think that life insurance is a big expense, but it’s often surprisingly affordable when purchased at a younger age: a recent

LIMRA study

found that over half of millennial consumers overestimated the cost of coverage at five times the actual amount!

Types of life insurance to consider

There are essentially two main types of life insurance coverage: term life or universal life. The policy type that you choose will depend on how much you want to pay, what features you want to include in your policy, and how long you want the policy to last.

Term life insurance

is coverage that you are taking out for a specific period, usually from 10-30 years. For example, if you take out a 20-year policy and pay your premiums when they are due, you will be covered for the extent of this period if you were to pass away unexpectedly. So, if you pass away after 19 years of owning the policy, your named beneficiary will receive the proceeds of the policy. The policy expires at 20 years, so if something happened after the policy had lapsed, your beneficiary would not receive benefits.

On top of being one of the most affordable types of life insurance, some term life policies include a return of premium option. This means that if you don’t pass away during the policy term, you could receive the money back that you paid in premiums.

Universal life insurance

is a permanent life insurance with a lot of flexibility. Universal life offers features that aren’t included in a term or whole life policy; in addition to providing a death benefit, the policy offers flexible premiums and a cash value savings component that can be used to supplement income during retirement or pay off other expenses.

An

Indexed Universal Life insurance policy

(IUL) is a great option for 30-year-olds looking for a policy with investment potential. This policy includes life insurance protection as well as a cash-savings component that can be indexed to a financial market index. This offers you the potential to invest while still providing the protection of life insurance coverage. Purchasing an IUL at a younger age results in much more affordable the premiums, so it’s a great life insurance option for people in their 30’s.

It’s easier than ever to get rates and choose a policy

Using a website to get an

online life insurance quote

can be very helpful: estimates are compared to real price quotes that were sent to people similar to you in age, health, financial status, and more. The human connection is still a valuable part of choosing a life insurance policy: only

3 in 10 consumers

say they would purchase life insurance strictly online. When you meet with a licensed insurance agent, you will be able to learn about all your options and have a trusted partner walk you through the entire process.

The bottom line

If you have others who depend on you financially or plan to start a family, life insurance is a valuable asset to purchase in your 30’s.

At Symmetry, we can help you find the right life insurance plan for your needs. Symmetry Financial Group offers personalized advice through our nationwide team of agents. Your agent can help you choose a plan that fits perfectly into your budget, no matter what stage of life you are in.

Try our

Request a Quote

form or give us a call to get connected with an agent near you. Don’t wait to take this step – get started today!