If you are lucky enough to have a job with benefits that include employer-sponsored group life insurance, you're off to a great start. Taking advantage of group term life insurance rates can be a great way to supplement individual life insurance coverage, but an employer group policy is usually not enough by itself. Read on to learn why it’s important to have a

personal life insurance

policy – and how to secure an affordable plan in a few simple steps.

Key takeaways:

-

You usually can’t take your employer’s life insurance with you if you switch jobs

-

Converting an employer plan to your own can be costly

-

Employer-sponsored life insurance might not be the cheapest option for your needs

Employer-sponsored coverage is usually not portable

In most cases, if you cut ties with your employer, you’re not able to take your life insurance coverage with you. So, when your employment ends, your life insurance coverage ends. If you still need life insurance at that point, you will need to be able to qualify for a new policy based on your age and health at that time. Since future health is always a big unknown, you may find yourself in a situation where you are unable to obtain the coverage you and your family need.

Converting your policy, if available, could be costly

Although rare, sometimes an employer-sponsored group policy can be converted to universal life insurance that you could manage and own. However, remember that the cost of insurance is based on your age and health when the policy is issued. In the case of a term-to-universal conversion, the policy actually starts when you convert it, so, while you may not have to worry about being able to qualify for that coverage, your premiums will likely give you some sticker shock.

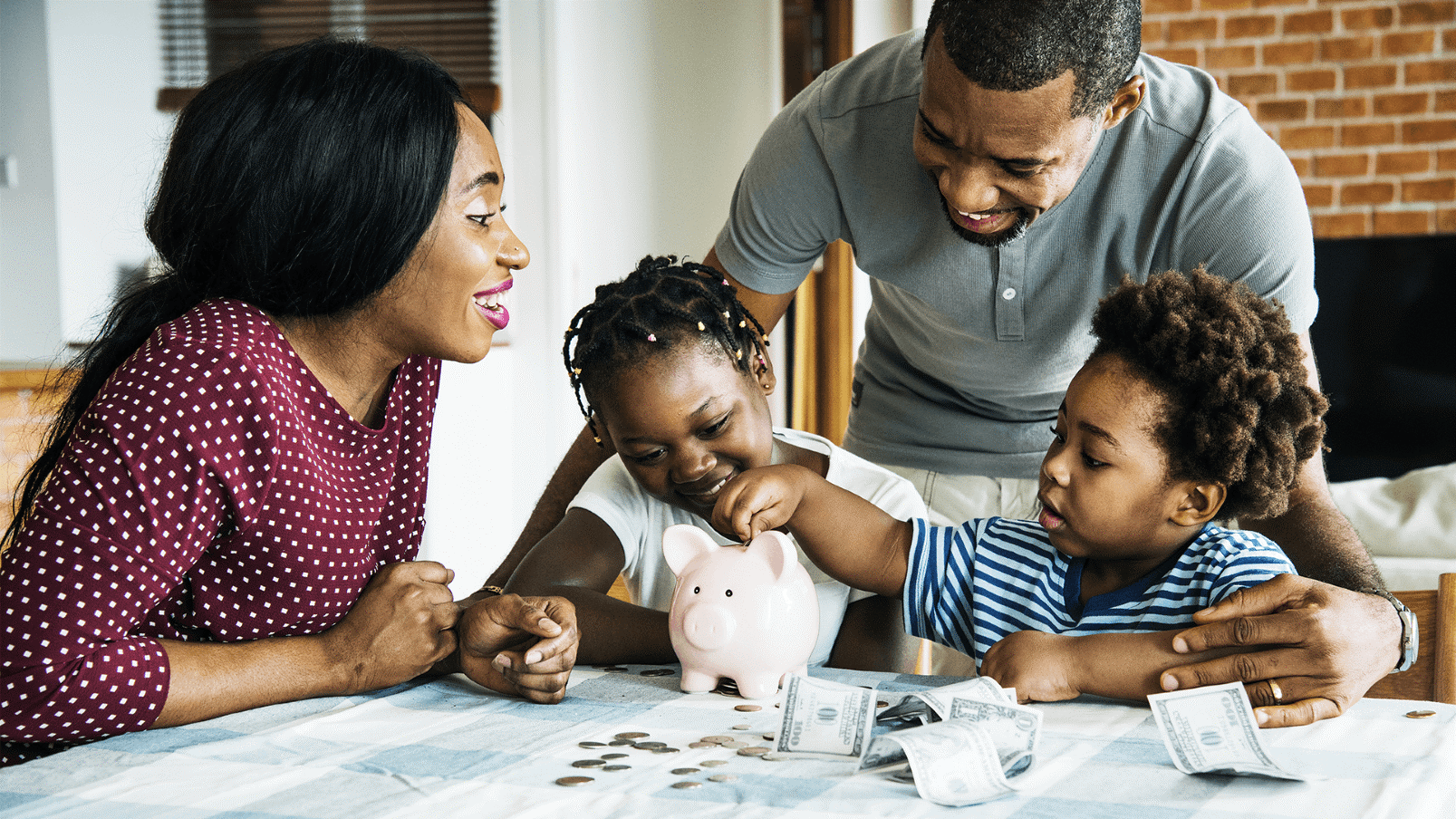

Potentially insufficient coverage

Another problem with relying solely on your employer-sponsored benefits is that the amount of insurance coverage you are able to purchase may not be enough to meet your needs. Death benefits of one-to-two times your annual salary may seem sufficient when you're just getting started in your career. However, for employees with dependents, with significant mortgage loans or other types of debt, the need for insurance protection is likely to be greater than what you are able to buy at work.

Employer-sponsored coverage may not be the cheapest option

While the premium amount you're quoted for an employer-sponsored plan may seem attractive, you may actually be able to get a better deal when you shop for coverage on your own. And of course, when you do that, you - not your employer- have full control of the policy.

The bottom line

Everyone has different life insurance needs. In most cases, you should not rely entirely on life insurance benefits obtained through your employer. Group life insurance can be a great way to supplement your individual

life insurance

coverage, but it’s usually not enough to provide full financial protection for your loved ones if you were to pass away, become disabled, or face a critical illness.

At Symmetry Financial Group, we offer free consultations to help you take advantage of your employee benefits while still making sure you are protecting your loved ones.

Want life insurance that won’t change if your job title changes? We can help!

At Symmetry, we are passionate about helping people insure their entire life’s journey. Your Symmetry agent has access to more than 30 well-known life insurance carriers, so we can find you options designed to meet your needs - and your budget.

To learn more,

request a quote for life insurance

today – video consultations are available to help you get a plan in place from the comfort of home.