If you have purchased insurance to protect your loved ones in the event of your death, disability or critical illness, congratulations. You have taken an important step and should feel good about being proactive. However, life isn't static for most of us; things change over time. When a major life event occurs, your insurance needs can change. If you don't adjust your coverage to reflect those changes, your policy might not meet your goals anymore.

Here are several life changes that can trigger a change to your insurance coverage.

Marriage

Going from "me" to "we" probably means that you're pooling resources and depending on each other's income and assets, at least to a certain extent. Getting married is an important time to

review insurance coverage

. Do you have enough insurance to help make up for your lost income in the event of your premature death? What if you become disabled or become critically ill? These events are also good times to review your beneficiary designations on existing life insurance policies and to change them to your new spouse if it makes sense to do so.

Buying a House

If you're buying a house, the odds are good that you're also the proud new owner of a mortgage. If you were to be diagnosed with a

critical illness

or became disabled, would you still be able to make the mortgage payments, property tax payments, and homeowners insurance premiums? If not, talk to your insurance professional about insurance products that could

help you stay in your home

if the worst happened. You may also need to buy more life insurance if one of your goals would be to provide funds to pay off the remaining mortgage at your death.

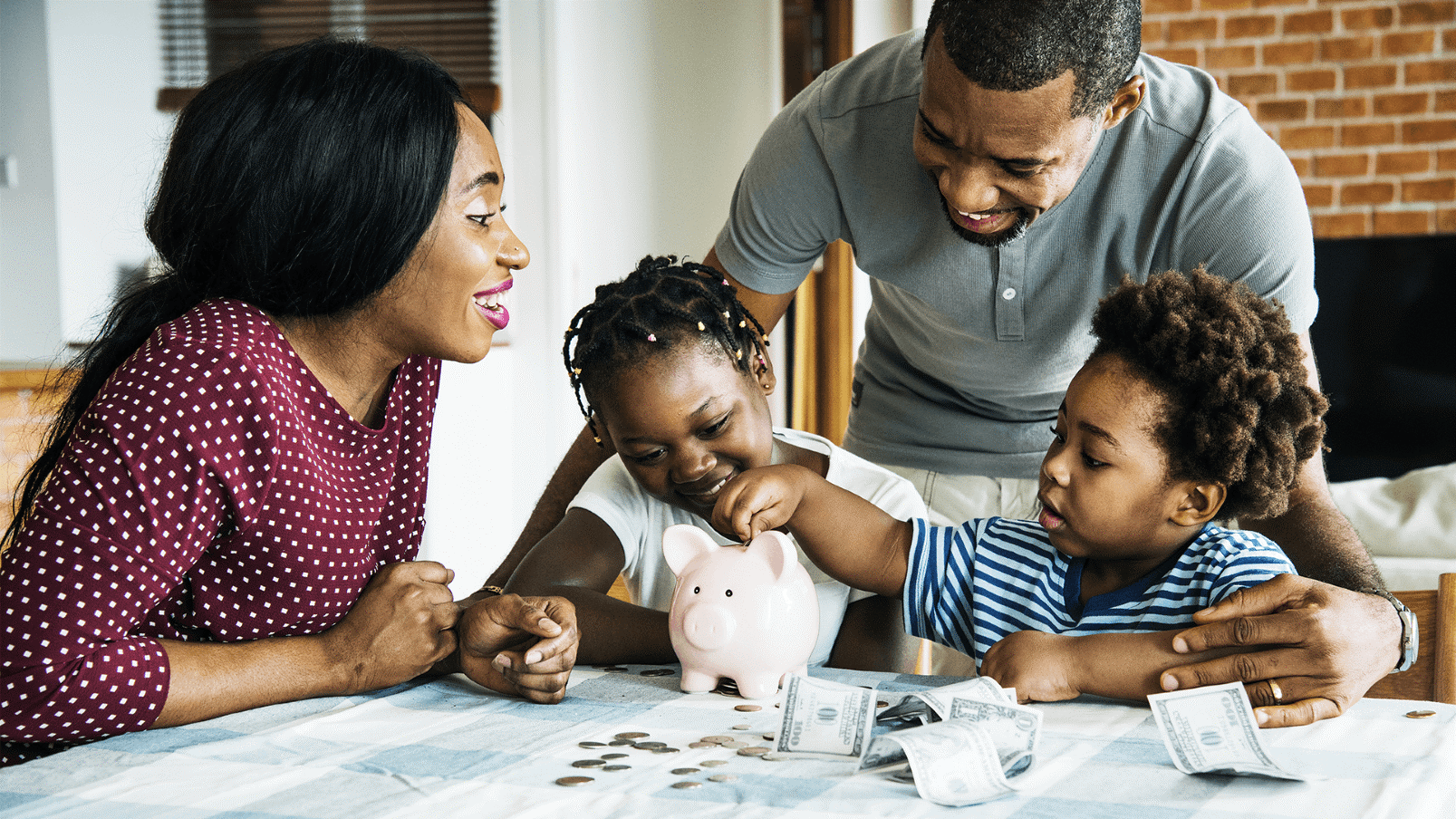

A New Child

The birth or adoption of a child is another important time to reassess your insurance needs and coverages. If you want to make sure funds are available to care for your child regardless of your health status, or after your death,

SmartStart insurance

can be the answer. Some people also want to buy life insurance coverage that could help fund their child's education in the event of the parents' premature deaths. Consider also purchasing a life insurance policy on your child's life. Doing so can provide funds for

final expenses

in the event of your child's death, but it can also protect them by ensuring coverage is there even if your child's later health means she isn't insurable in the future.

Retirement

Retirement

is an exciting time in your life, as you have the time to do the things you couldn't do during your working years. If you purchased

disability income insurance

, you may no longer need it. Your reasons for purchasing life insurance may have changed over time, so it is important to reassess those needs.

If you have experienced a major life event recently, or if it has simply been a while since you reviewed whether your life insurance is still meeting your needs, it's time to sit down with a Symmetry Financial Group insurance professional.

Contact us online

or call us at (877) 285-5402 to find the perfect life insurance policy for your needs